Two years since the COVID-19 pandemic began, the U.S. housing market remains in the midst of a historic frenzy.

With low interest rates, strong savings and investment returns throughout most of the pandemic, and the Millennial generation reaching peak home-buying age, the market has seen a rush of buyers competing for homes and driving prices to record heights. And while interest rate hikes over the remainder of 2022 could discourage would-be buyers, the U.S. also faces a shortage of housing supply that is unlikely to be resolved anytime soon. According to data from mortgage backer Freddie Mac, the U.S. has a deficit of 3.8 million housing units. And with global supply chains still recovering from pandemic disruptions and inflation driving costs higher, new housing stock is likely to be more time-consuming and more expensive to build for the foreseeable future.

The housing market’s competitive conditions have put pressure on buyers to bid aggressively to beat out other offers. Many buyers are waiving appraisals and home inspections or offering to pay well above asking price to entice sellers. Financing is another tactic for buyers attempting to make competitive offers. Buyers with sufficient resources are offering to pay for homes in cash, and even among those who do require home loans, down payments above the traditional 20% have become more common.

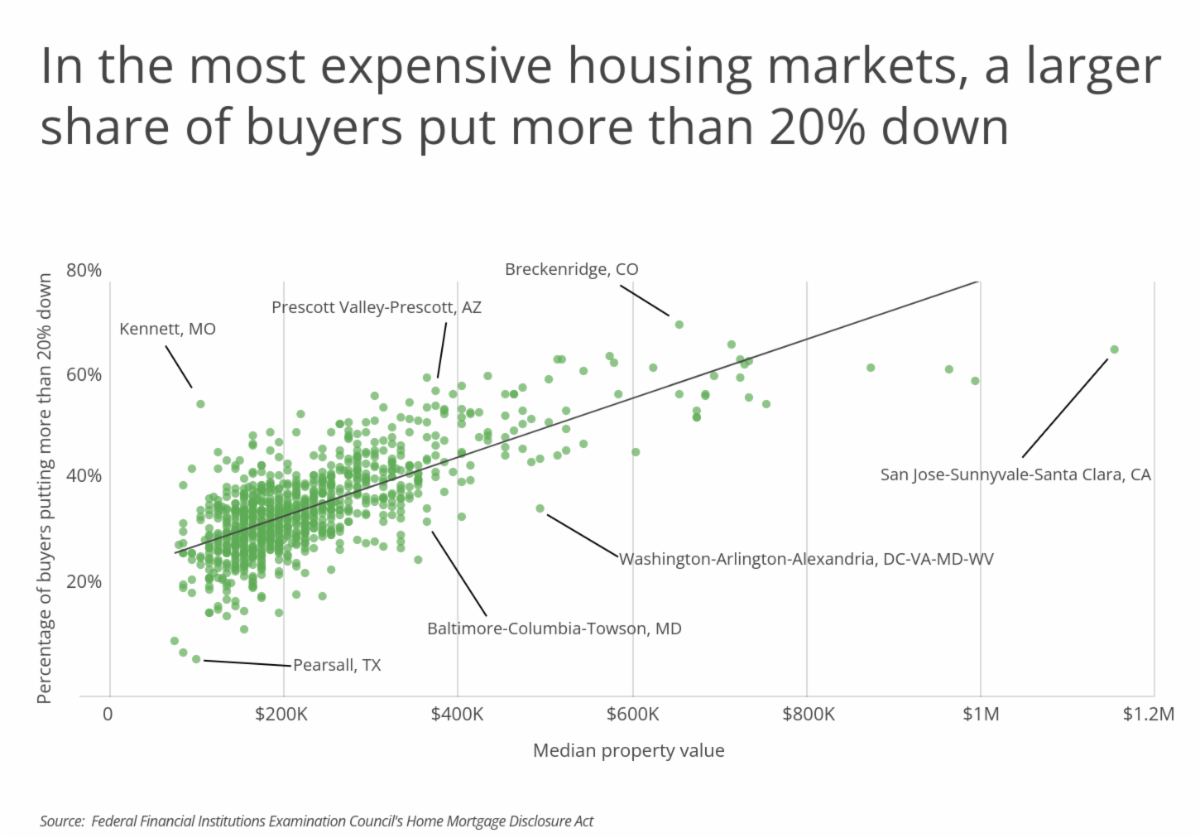

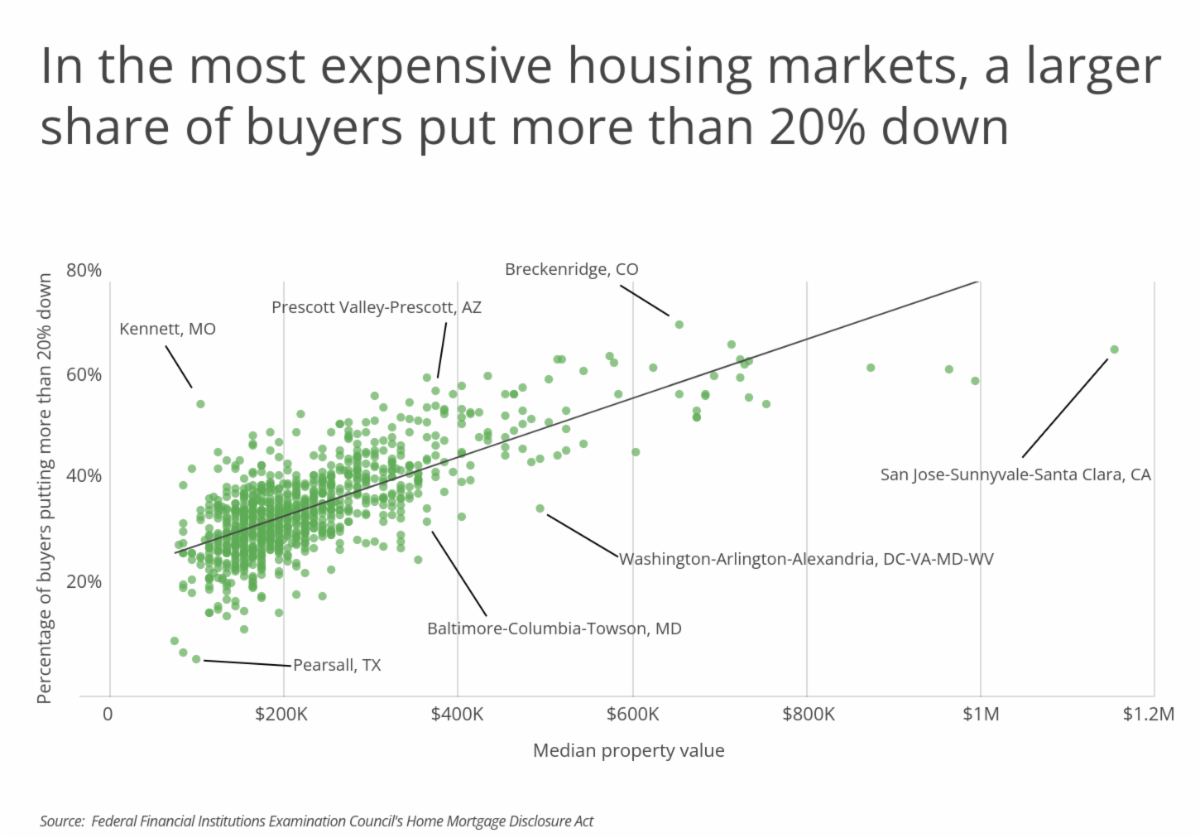

Nationwide, the percentage of buyers who put more than 20% down rose from 43.5% in 2019 to 53.3% in 2020. And these larger down payments are especially common in more expensive, competitive housing markets. In 24 of the 25 markets with the highest median property values in the U.S., a majority of homebuyers have down payments of greater than 20%.

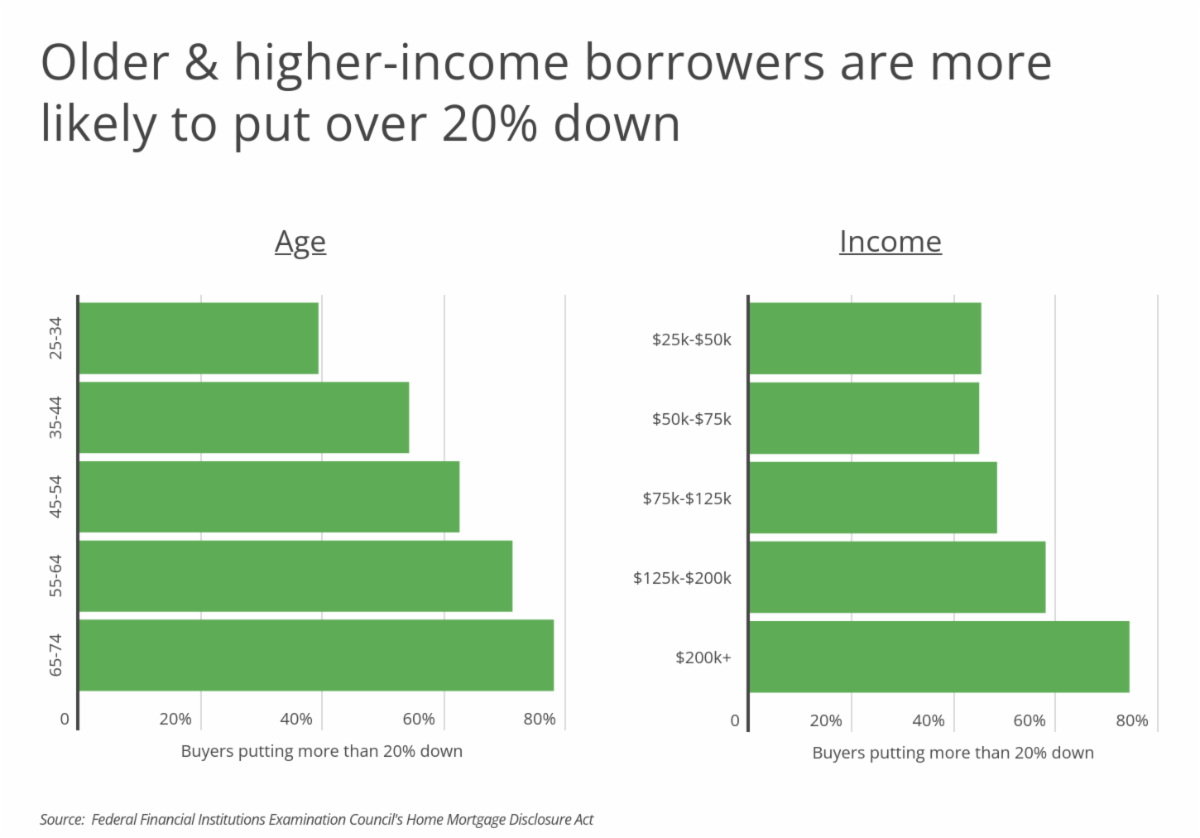

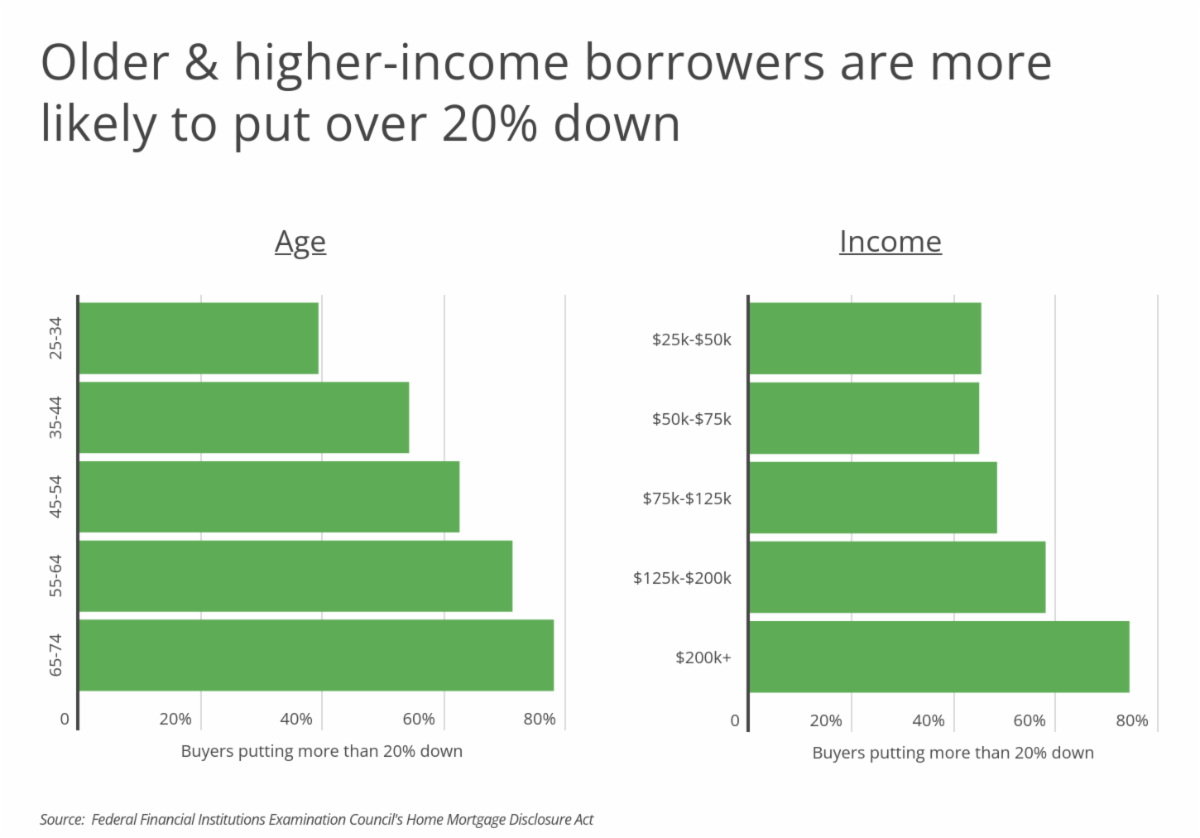

The trend toward offers with more money down on the mortgage could put homeownership further out of reach for younger and lower-income buyers. Older and higher-income people are more likely to have greater savings or existing equity to put toward a home loan. Less than 40% of borrowers aged 25 to 34 put down more than 20%, but at least half of borrowers in every other age group do, and big down payments become increasingly common among older people. By income, less than half of all those earning less than $125,000 annually put down more than 20%, compared to 57.9% of those earning between $125,000 and $200,000 and 74.3% of those with incomes above $200,000.

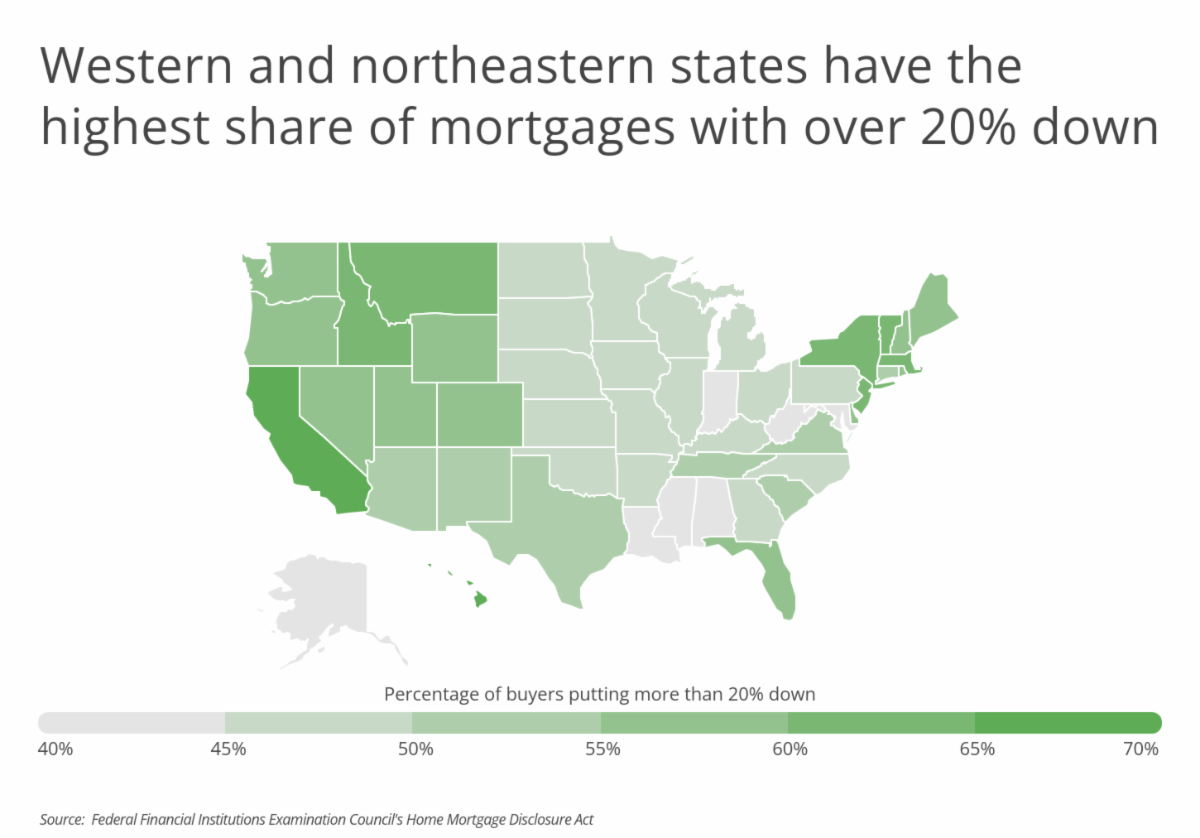

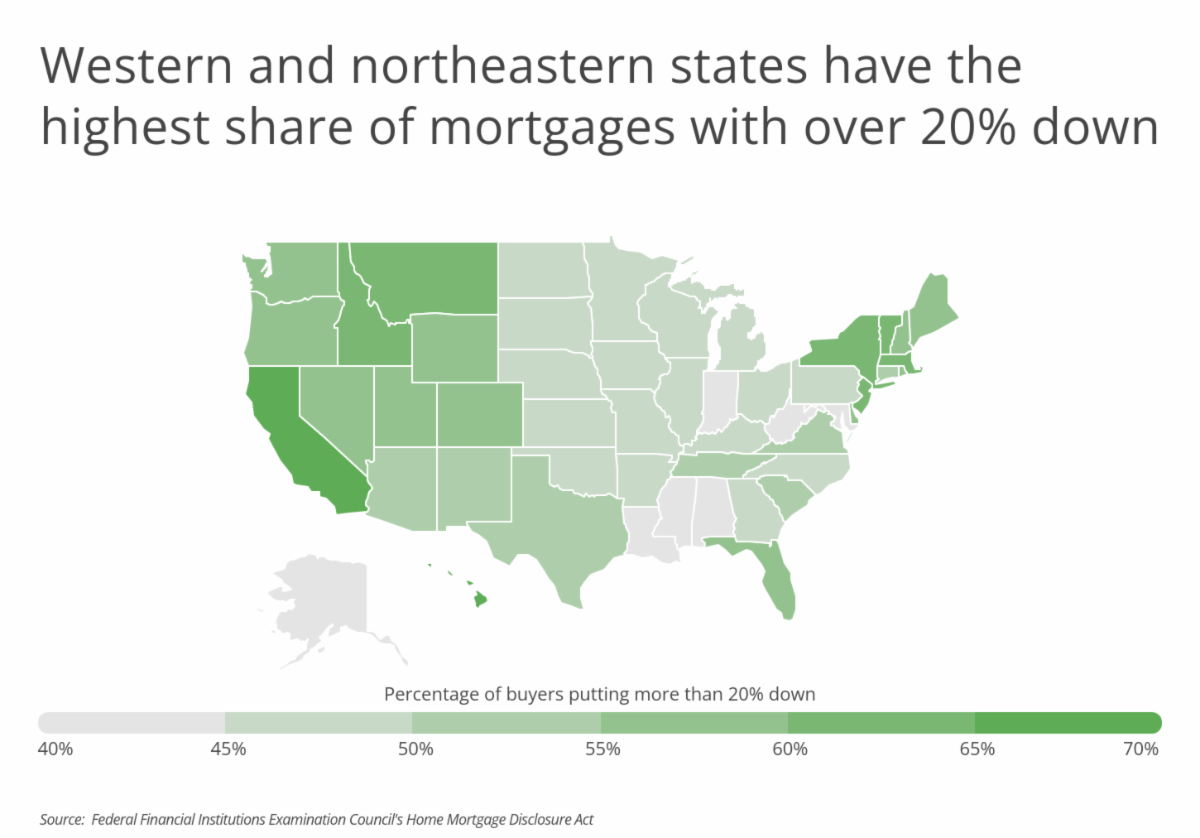

Because the practice of putting more money down is most common in expensive markets and among older or higher-income buyers, not every U.S. location is seeing this trend as commonly. Affordable states with lower income, like Mississippi and West Virginia, are among the locations with the fewest buyers using larger down payments. In contrast, more than two-thirds of buyers are putting down more than 20% in the two most expensive states for housing, Hawaii and California. And at the local level, California is also home to six of the 15 top large metros (those with at least one million residents) for down payments above 20%, including each of the top four.

To determine the states where buyers put the most down on their home purchases, researchers at Inspection Support Network analyzed the latest data from the Federal Financial Institutions Examination Council's Home Mortgage Disclosure Act. Only conventional, home purchase loans that originated in 2020 were considered in the analysis. The researchers ranked states by the percentage of buyers putting more than 20% down. In the event of a tie, the state with the larger median down payment amount was ranked higher.

The analysis found that 48.2% of buyers in Georgia put more than 20% down on their home purchases, with a median down payment amount of $40,000. Here is a summary of the data for Georgia:

- Percentage of buyers putting more than 20% down: 48.2%

- Median down payment amount: $40,000

- Median loan amount: $245,000

- Median property value: $295,000

- Median interest rate: 3.250%

- Median down payment to income percentage: 36.7%

For reference, here are the statistics for the entire United States:

- Percentage of buyers putting more than 20% down: 53.3%

- Median down payment amount: $50,000

- Median loan amount: $255,000

- Median property value: $325,000

- Median interest rate: 3.250%

- Median down payment to income percentage: 43.5%

For more information, a detailed methodology, and complete results, you can find the original report on Inspection Support Network’s website: https://www.inspectionsupport.com/resources/cities-where-people-are-putting-the-most-down-on-their-home-purchases/

|

|

|

|