An Average 21.2% Of Georgia Renters Were Behind on Payment, 5th Most in U.S

Monday, March 7th, 2022

Throughout the COVID-19 pandemic, growing rent debt and the possibility of widespread evictions have been a major worry for many households and for the economy as a whole. Renters are more likely to work in the sorts of lower-wage occupations that have been most disrupted by the pandemic, like retail and hospitality, and less likely to have savings or other assets to help them weather hard times. These factors have made it harder for renters to keep up with their payments, and in turn, many landlords—especially smaller-scale property owners—are struggling to make up income and cover payments to lenders.

To stave off economic disruption from these conditions, policymakers identified financial support for renters as a need early in the COVID-19 pandemic. The federal government established eviction moratoriums to protect renters and appropriated nearly $50 billion in emergency rental assistance to help renters make payments, and many states and local governments supplemented these efforts as well. But the Supreme Court struck down an eviction moratorium in August 2021, and after a slow start, states are now rapidly spending down their share of the federal rental assistance programs.

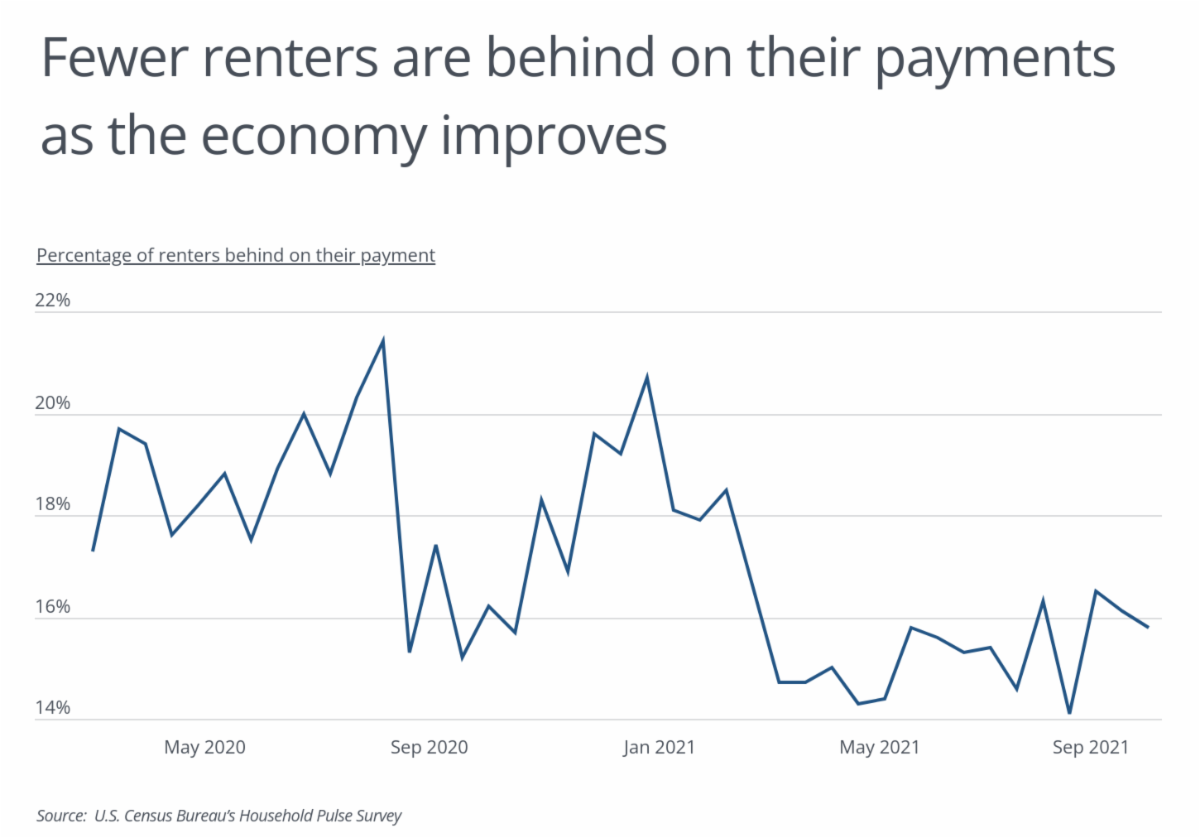

The picture for renters has improved somewhat over the course of the pandemic, but many renters are still struggling, according to data from the U.S. Census Bureau’s Household Pulse Survey. The percentage of renters who reported being behind on their payments increased substantially in the first few months of the pandemic as early COVID-19 lockdowns temporarily shuttered many businesses and eliminated millions of jobs. After spiking at 21.4% in July of 2020, this share began to drop as lockdowns eased, but rose again with a major wave of cases late in 2020 that once again hobbled many parts of the economy. In 2021, a decline in cases early in the year, the availability of vaccines, and overall improvement in the economy kept the share of renters behind on rent below 16% for much of the year.

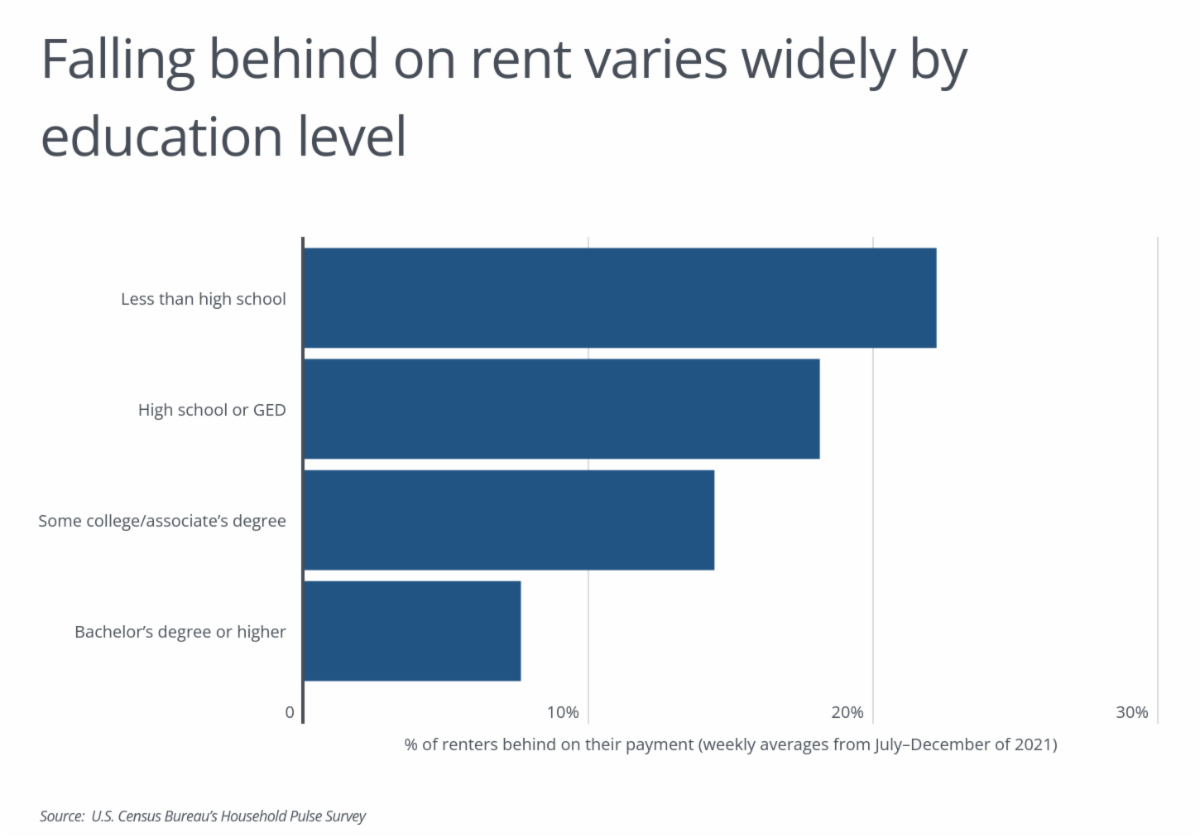

But as with many aspects of the economy during the pandemic, the downstream impacts of things like business closures, layoffs, and a lack of child care were more likely to affect certain socioeconomic and demographic groups. In part, because job loss during COVID was more heavily concentrated among low-wage workers, so too was trouble paying bills, buying food, and making rent. According to data from the Census Bureau, the likelihood of being behind on rent drops substantially with each higher level of education. Of those with less than a high school diploma, an average of 22.2% were behind on their rent during the same time period. That figure declines to 18.1% for high school graduates or GED holders, 14.4% for those with some college, and just 7.6% for those with a bachelor’s degree or higher.

|