Weekly Earnings Growth Continues to Increase as Jobs Growth Holds Steady

Wednesday, February 5th, 2020

The latest Paychex | IHS Markit Small Business Employment Watch reflects a continuation of the tight labor market to start 2020. Weekly earnings growth improved for the 13th consecutive month, reaching 3.59 percent in January. Weekly hours worked were up 0.83 percent from last year, contributing to the growth in weekly earnings. The pace of small business employment growth remains consistent, with the national jobs index increasing slightly (0.01 percent) in January to 98.18.

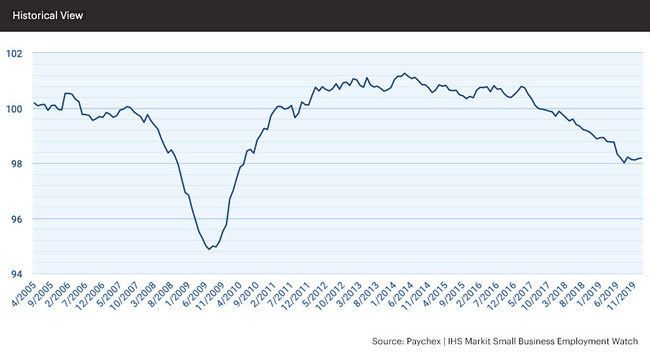

"The national index has been flat since mid-year 2019, signaling a continued tight labor market for small businesses," said James Diffley, chief regional economist at IHS Markit.

"With election season heating up and the economy top of mind for business owners, this month's Small Business Employment Watch demonstrates the continuing stability of jobs growth recently, as well as weekly earnings improvement," said Martin Mucci, Paychex president and CEO. "The data shows consistent employment growth and yet another month of encouraging wage growth, two key indicators that the economy is off to a solid start in 2020."

Broken down further, the January report showed:

The South continues to top regions for small business employment growth; the West remains the leading region for hourly earnings growth.

Tennessee ranks first among states in small business job growth; New York leads in hourly earnings growth.

Phoenix became the top metro for small business job growth; San Francisco leads metros in hourly earnings growth.

At 5.12 percent, Leisure and Hospitality leads hourly earnings growth among industry sectors.

The complete results for January, including interactive charts detailing all data at a national, regional, state, metro, and industry level, are available at www.paychex.com/employment-watch. Highlights are available below.

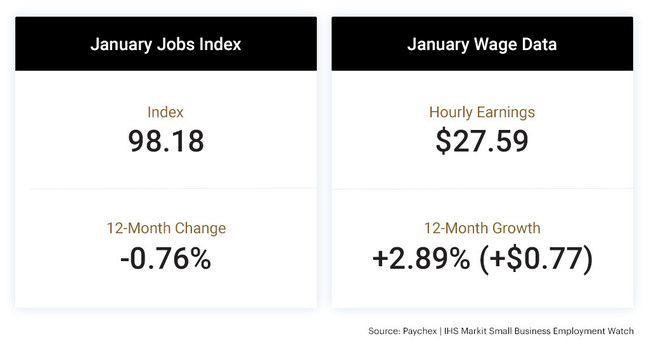

National Jobs Index

The decline seen in small business employment growth during the first half of 2019 has given way to hiring stability over the past two quarters.

Up a modest 0.01 percent in January, the national index continues to show very little change in job gains.

At 98.18, the Paychex | IHS Markit Small Business Jobs Index is up 0.04 percent during the past quarter, but down 0.76 percent from last year.

National Wage Report

Weekly earnings growth reached 3.59 percent, improving for the 13th straight month.

At 2.89 percent, hourly earnings growth dipped below the three percent mark to begin 2020.

Weekly hours worked are up 0.83 percent from last year.

Regional Jobs Index

Above 98, the Northeast is reporting positive year-over-year growth for the first time in nearly three years. Strong performance in the Leisure and Hospitality sector is a contributor to that growth, up 2.60 percent since last year in the Northeast.

Led by California, the West fell sharply in January (down 0.69 percent), and is now the weakest region for small business job gains.

At 99.13, the South is the strongest region for job gains, up 0.26 percent in January.

Regional Wage Report

The West leads in hourly earnings and hours worked growth, with weekly earnings accelerating for the 12th consecutive month to 4.35 percent in January.

Due to an increase in hours worked, weekly earnings are on the rise in the Midwest, up to 2.81 percent this January compared to 1.97 percent in January 2019.

State Jobs Index

Fourteen of the 20 states reported an increase in the pace of employment growth in January.

Down 1.13 percent from the previous month and 2.47 percent from last year, California now has the lowest index among states at 96.67.

Tennessee and Arizona are the only states above 100.

Note: Analysis is provided for the 20 largest states based on U.S. population.

State Wage Report

New York, California, and Tennessee lead wage growth among states.

Paired with a significant decline in job growth, California is the top state for weekly hours worked and weekly earnings growth.

Texas trails all states in hourly and weekly earnings growth, 1.50 percent and 2.18 percent, respectively.

Note: Analysis is provided for the 20 largest states based on U.S. population.

Metropolitan Jobs Index

Phoenix became the top metro for small business job growth in January as Dallas slowed for the sixth consecutive month.

The Southern California metros of Los Angeles, Riverside, and San Diego had the three weakest one-month growth rates among metros.

Note: Analysis is provided for the 20 largest metro areas based on U.S. population.

Metropolitan Wage Report

San Francisco (4.25 percent) and Los Angeles (4.23 percent) are the only metros with hourly earnings growth above four percent.

At 3.77 percent, hourly earnings growth is surging in Baltimore.

Houston (1.16 percent) and Tampa (1.26 percent) trail significantly in hourly earnings growth.

Note: Analysis is provided for the 20 largest metro areas based on U.S. population.

Industry Jobs Index

All industry sectors saw growth in January, except Leisure and Hospitality, down 0.53 percent.

Trade, Transportation, and Utilities and Manufacturing remain below 97, though both reported positive gains during the past three months.

Note: Analysis is provided for seven major industry sectors. Definitions of each industry sector can be found here. The Other Services (excluding Public Administration) industry category includes religious, civic, and social organizations, as well as personal services, including automotive and household repair, salons, drycleaners, and other businesses.

Industry Wage Report

At 5.12 percent, Leisure and Hospitality leads hourly earnings growth among sectors, with Manufacturing a distant second at 3.61 percent.

Education and Health Services trails all other sectors in hourly earnings growth at 1.56 percent.

Construction slowed below three percent hourly earnings growth in December for the first time in 2019, and fell further in January to 2.71 percent.